Our policies are available exclusively through UK brokers

Frequently asked questions

If you can't find the answer you're looking for? Contact our team who will be happy to help.

Search Results

-

Claims (Broker)

How do I make a claim?

If you’ve had an accident, please call us within 24 hours on 0330 123 5992. We’ll organise your car for repair and get you a replacement vehicle should you require one.

Your car will be looked after by our approved network or repairers, cleaned, valeted and delivered back to you at home or work

What should I do in the event of an accident?

- Once everyone is safe, please phone us immediately (and definitely within 24 hours) on 0330 123 5992 for general claims or 0345 602 3378 for windscreen claims

- Give the other party your car registration, name and phone number and tell them you’re insured with ERS. Make sure you get the same details from them.

- Take photographs of damage to all vehicles and the scene of the accident if it’s safe

- Make sure you take a note of the number of people in the other vehicle(s)

What happens when my car is taken for repair?

If your vehicle has been involved in an accident, we’ll collect it and deliver it to one of our approved network or repairers.

We’ll keep you updated through the claim (or pass the information to your motor insurance broker), so you know when your vehicle will be ready.

ERS only use original parts by default, so you know you’ll get exactly the right parts for your vehicle – unless you ask us not to. Once it’s repaired, it’ll be fully valeted and delivered back to you at home or work.

Who do ERS use as their approved repair network?

ERS works with the Innovation Group and their national network of approved repairers. Our repair network can look after pretty much any vehicle type, from a standard car or van to a Tesla, McLaren or Bentley and, as we only work with BS10125 accredited repairers, your customers’ vehicles are in safe hands. What’s more, we’ll provide your customers with a courtesy car and, once your vehicle is repaired, deliver it back to you at home or work valeted inside and out.

How to submit a good claim to ERS

To help our engineers progress the claim quickly, it's important you take good quality images and videos. Here are a few tips to help:

Ensure you take some vital shots:

- Take a photo of your driving license / passport

- Take a photo of the VIN and the vehicle registration plate

- Take shots of the interior of the vehicle including seats, dashboard (with mileage)

- Then, outside the car, from each corner so we can see the front, sides and rear

Once the vitals are done, you need to send photos of the damage

- It’s important to get a tight photo of the damage, so stand nice and close

- Ensure you get a few photos from different angles, including underneath the car. The more photos the better.

Once you’re done, send your photos / videos to your broker who can submit them on your behalf.

Which vehicle classes and schemes do differential excesses apply to?

Differential excesses applied to all new business and renewals on Everyday Car and Taxi products between 1st August 2017 and 31st May 2019. For policies incepted or renewed from 1st June 2019, the differential excesses relating to late reported claims, and discounts for early reported claims will only apply to Taxi and High Risk car and van schemes. There will be no change to the increased excess where your vehicle is repairable, but not repaired at one of our Approved Repairers.

What do the differential excesses apply to?

Where applicable, the discounted early reporting excess, increased late reporting excess and non-approved repairer excess is applied to the AD element of an RTA claim only and will be paid in addition to any other excess on a claim. The excesses are cumulative.

Why do you have differential excesses to some products and for repairs not in your network?

A claim that is not reported to ERS quickly can typically cost over £1,000 more than a claim that is reported earlier. Ultimately increased costs can mean increased premiums for our customers, so we aim to reduce costs as much as possible to keep premiums low. The addition of a differential excess aims to encourage brokers and policy holders to report claims early, helping us manage the claim and keep costs low.

We have introduced a discounted excess for policy holders who report a claim within 1 day and a late reporting excess to claims reported in more than 2 days after the incident. These excesses apply to RTA claims where there is a third party road user involved (e.g. TP driver, TP passenger, cyclist, pedestrian, own passenger, motorcyclist).

Repairs where non-approved repairers are used cost ERS considerably more on average, hence the increased excess application to repairs when a non-approved repairer is being used.

What products are subject to the differential excesses?

Currently, Taxi, High Risk (Non-Standard) Car and Van are subject to differential excesses. Everyday Car and Van and Rural Car and Van products are subject to an excess if an ERS Approved Repairer is not utilised where the vehicle is repairable.

Do differential excess changes apply to all product Taxi, Car and Van wordings?

Currently, Taxi, High Risk (Non-Standard) Car and Van are subject to differential excesses. Everyday Car and Van and Rural Car and Van products are subject to an excess if an ERS Approved Repairer is not utilised where the vehicle is repairable.

However, these changes only apply to ERS’ own wordings. Brokers with their own policies do not need to change their terms.

What happens if the policy holder is unable to report the claim due to unforeseen circumstances?

Whilst we appreciate that there will always be exceptional circumstances, policy holders, named drivers or brokers are expected to notify ERS of a claim within the appropriate time frame unless they are unable to do so. In exceptional circumstances, such as the policy holder being seriously injured in the accident, we will apply our discretion as to whether the late reporting excess applies.

When can claims be notified to ERS?

A policy holder, named driver or broker can report a claim to ERS 24 hours a day, 7 days a week, including public holidays.

When does the reporting window start for a claim?

The reporting window starts on the day of the accident. Rather than apply a strict 24/48 hour window. However, ERS provides some leeway in terms of timing. If the accident occurs at 9am on Sunday, Sunday is day 0, Monday is day 1, Tuesday is day 2 and Wednesday day 3. Therefore, if the accident is reported to us on Sunday or Monday, the insured will get the benefit of a reduced AD excess, if reported on Tuesday, they pay their standard excess but if on Wednesday or later, they will pay the additional excess.

Can a relative of the policy holder notify ERS of the claim initially?

We only accept notification of claims from the policy holder, a named driver on the policy or the policy holder's broker.

What happens if the ERS approved-repair network cannot accommodate the required vehicle repairs?

If our approved network of repairers cannot repair the vehicle, we will not penalise the insured with an increased excess, however it is at our discretion as to whether the vehicle can be suitably repaired. This would also apply where the insured is in a remote location where there is no approved repairer.

What happens if I’ve already invited a renewal on the previous terms?

We will honour any renewals invited on the old terms regardless of when the terms are accepted.

Do these changes apply to all product Taxi, Car and Van wordings?

Currently, Taxi, Everyday Car and Van, High Risk (Non-Standard) Car and Van and rural Car and Van products are subject to differential excesses.

However, these changes only apply to ERS’ own wordings. Brokers with their own policies do not need to change their terms.

What happens if we have our own claims department and Accident Management Company?

Whilst the claim notification may initially be made to an accident management company, all claims must be made to ERS within the specific time frame.

ERS provide a claims notification service 24 hours a day, seven days a week to ensure all brokers and policy holders can notify us of a claim within the specified time

Do I need to report an incident, even if I don't intent to claim?

Yes. The policy holder, broker or accident management company must report any incident to us within the specified time frame, even if there is no intention to claim against the motor insurance policy. This is because liability is not always clear and can be disputed. If the policy holder subsequently wishes to claim on their motor insurance, they will be liable for the increased late reporting excess.

Where can I check the employer’s liability register?

The Employers' Liability Register shows each ERS employer's liability policy which has been entered into, renewed or for which claims have been made on or after 1st April 2011.

The register also shows any ERS employers' liability policy for which claims have been made before 1st April 2011 and have not yet been settled.

You can view our current Employer's Liability Register here.

If you have any queries regarding any policy shown on this register, please email our Compliance Team on compliance@iquw.com or call 020 3824 5589.

-

Complaints (Brokers)

How do I make a complaint to ERS?

If you have any reason to raise a complaint on behalf of our Policyholder, please see refer to our Policyholder response.

Written authority should be provided by the Policyholder prior to dealing with a complaint on their behalf.

If you as a broker are unhappy with our service, please contact your Regional Development Manager (RDM). A list of RDM’s by geographical area and contact details are available here.

Alternatively, email: brokerconduct@ers.com

Our office hours are 9.00am to 5.00pm, Monday to Friday.

Or you can write to us at the following address:

Customer Relations Department, ERS, Crucible Park, Llansamlet, Swansea SA7 0AB

Please quote the insurance document number in any communication, which is shown on the Policyholder’s certificate of insurance and schedule. If known, please quote the claim reference number.

How can I make a complaint to Lloyd’s?

Should you be dissatisfied with our response to your complaint, you can refer your complaint to Lloyd's. Lloyd's will investigate the matter and provide a final response. Lloyd's contact details are as follows:

Complaints

Lloyd’s

One Lime Street

London

EC3M 7HAE-mail: complaints@Lloyds.com

Telephone: +44 (0) 20 7327 5693

Fax: +44 (0) 20 7327 5225Website: www.lloyds.com/complaints

If you ask someone else to act on your behalf, you should give us written authority to allow us to deal with them.

How do I make a complaint to the Financial Ombudsman Service (FOS)

If you are dissatisfied with Lloyd’s final response, you may, if eligible, refer your complaint to the Financial Ombudsman Service (FOS). The Financial Ombudsman Service is an independent service in the UK for settling disputes between consumers and businesses providing financial services.

The FOS's contact details are as follows:

Financial Ombudsman Service

Exchange Tower

London

E14 9SRE-mail: complaint.info@financial-ombudsman.org.uk

Telephone: +44 (0)300 123 9123

Website: www.financial-ombudsman.org.uk

How long does a complaint take to resolve?

ERS resolve over 70% of complaints informally over the telephone within 3 business days.

Please see details of each stage of the complaint journey

Why is there more than one part to the complaints process?

As a Lloyd’s Market Syndicate, we follow the Lloyd’s Complaints Process (as agreed by the FCA).

Complaints not resolved informally within 3 business days will be subject to a formal investigation and written ‘Stage One’ response letter in accordance with the Lloyds complaints procedure.

Please see the timeline of a potential complaint journey.

How do we perform on complaints against industry competitors?

One of the Industry standard measures for complaints is: Complaints per 1000 Policies (as a percentage) Please see ERS performance when compared to industry competitors.

Insurer Complaints per 1,000 policies ERS 0.68 Ageas 0.79 Zurich 1.51 Markerstudy 1.89 NFU 2.36 RSA 2.64 AXA 4.73 QBE 6.08 -

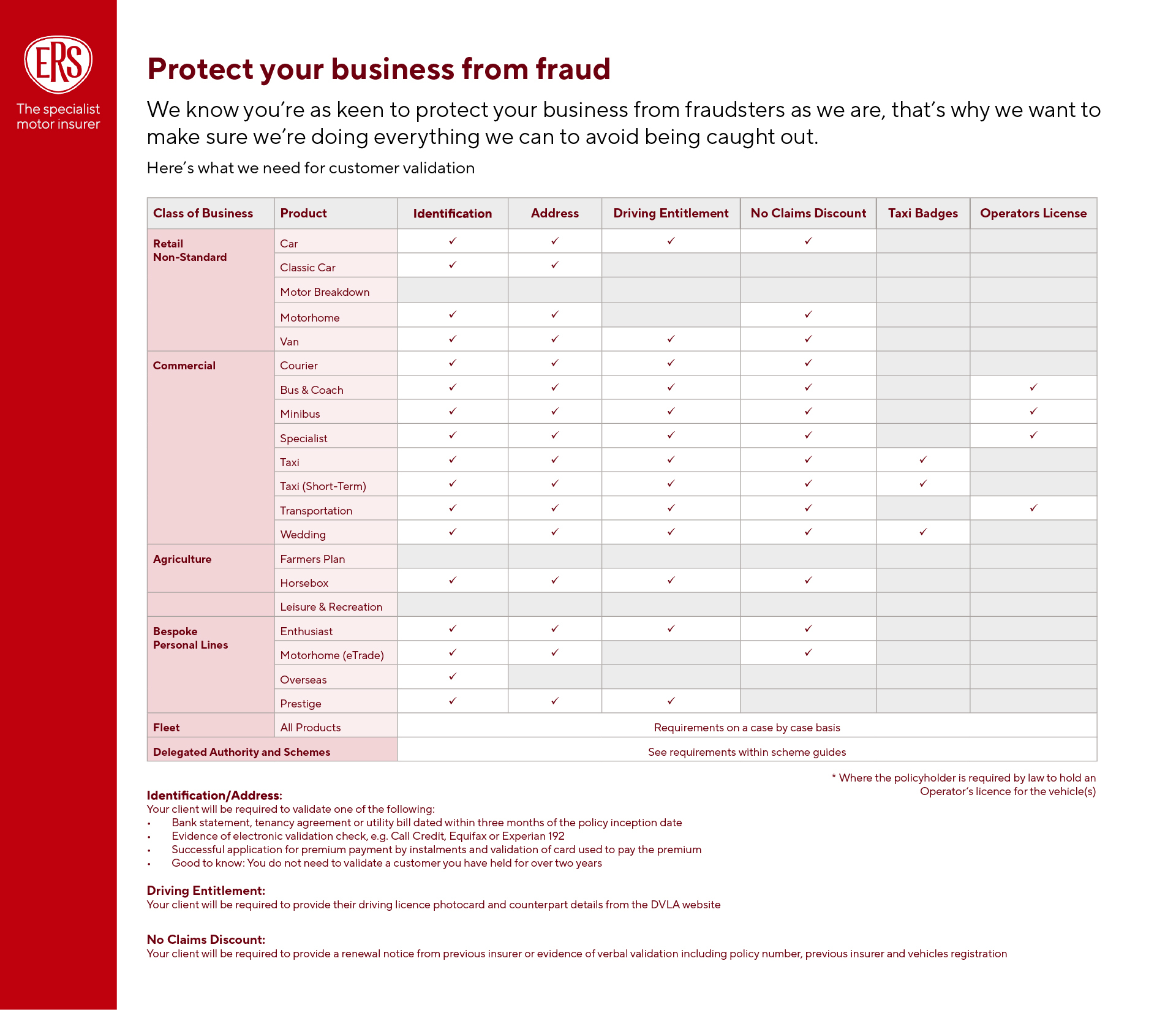

Fraud

How do I report claims fraud?

If you suspect fraud then please contact our dedicated hotline on 03300 535 891. All calls will be treated in the strictest confidence.

How does ERS prevent claims fraud?

ERS has a zero tolerance to claims fraud because it can negatively affect innocent policyholders in two ways:

- The Association of British Insurers believes that it adds £50 to the cost of motor insurance premiums.

- Criminals may seek to manoeuvre innocent motorists into induced accidents in order to benefit from claims.

If you suspect fraud then please contact our dedicated hotline on 03300 535 891. All calls will be treated in the strictest confidence.

How does ERS prevent application fraud?

It is important that your insurance policy is based on the correct information.

Providing incorrect or false details, or failing to disclose information when requested, could render your insurance policy as 'null and void' or cancelled.

To ensure we sell the correct cover, the following are details which may be checked by ERS, or your broker on our behalf:

- Your claims history

- Your identity

- Your address

- The validity of any debit or credit card used to purchase your policy – to ensure that stolen and cloned cards are not used

- Your No Claims Bonus entitlement

- The ownership of your vehicle

- Any motoring convictions you have

- Your taxi license - if applicable

- That approved security devices are fitted - where required under our policy terms Whether you or any named drivers have had previous insurance cancelled or declared void for fraud reasons

Who does ERS work with to prevent fraud?

To help prevent fraud, we work with the following organisations:

- Insurance Fraud Bureau - the IFB are a 'not for profit' organisation focussed on detecting and preventing organised insurance fraud.

- Insurance Fraud Enforcement Department - the IFED are a dedicated team at City of London Police, targeting the investigation of insurance fraud at all levels and from all sectors.

ERS Validation requirements

-

Cover Note and Green Card portal (Broker)

How can I access the ERS Cover Note & Green Card Portal?

Brokers can register using this form. Once this has been submitted ERS will review the application and users will get an email once approved.

If you already have your log in details, you can sign in here.

Please note:

- Shared inboxes, shared login details, and/or shared authenticator apps/devices are not permitted.

- Username & Passwords for this site are not the same as ERS Online.

- Password resets can be made by following this link. This will require a username to be provided, if you cannot remember your username contact agency@ers.com

How do I raise an e-cover note?

You can use our e-cover note portal to provide insurance for your customers if we’re not available and if you have the authority to do so. Sign in to the ERS Cover Note and Green Card Portal.

How do I report an issue when using the ERS Green Card and Cover Note Portal?

If it is an account issue no longer have access to your email account, users needing deactivation etc.), please contact agency@ers.com and if it is a technical issue (Portal is offline, server/page/redirect errors etc.) please contact servicedesk@iquw.com

Green Cards

For more information on Green Cards please see the Leaving the EU and Green Cards section.

How do I gain access to Cover Notes and Green Cards created before 21.09.2023?

Please contact agency@ers.com for any Cover Notes and Green Cards created before the 21.09.2023

Is there any training material to support users of the ERS Cover Note and Green Card Portal?

You can view the ERS Cover Note and Green Card Portal guide here.

-

Broker marketing (Broker)

What marketing support do you offer to your brokers?

Sign up to our Marketing Hub to download and co-brand a range of leaflets to support your marketing initiatives. Sign up here.

Our ERS Stories get under the bonnet of some of the vehicles we cover with our broker partners; sharing incredible stories of fantastic vehicles, their drivers and the brilliant things they do.

If we’ve covered a risk that would make a great ERS Story get in touch with the team at communications@ers.com

Can I use the ERS name and logo in my communications?

Yes. We’re happy for you to use the ERS name logo in your communications, but please refer to our Terms and Conditions for a few rules.

You can get the latest logo by emailing communications@ers.com.