Our policies are available exclusively through UK brokers

Frequently asked questions

If you can't find the answer you're looking for? Contact our team who will be happy to help.

Search Results

-

FCA Fair Pricing

Are you are the product manufacturer or co-manufacturer?

ERS is the manufacturer of all Products sold by this broker branded as ERS throughout the customer document pack.

Have you carried out a PROD assessment on each available product?

ERS has a Product Review Framework and supporting Product Review Plan that is approved annually by the ERS Board. All products reviewed are presented to the Product Oversight Group (POG) for their approval and actions set. Quarterly updates are provided to the ERS Risk and Compliance Committee on behalf of the ERS Board.

Have you identified the target market for each product?

Yes, a Product Review assesses the target market with demographic data against the Risk Appetite set by Underwriters for each Product to ensure we identify anomalies to this and take appropriate action, where needed.

The core elements of an ERS Product Review are:

- Coverage offered across all the schemes for the product

- Benchmarking across the motor insurance market (a minimum of 3 competitors)Identification of strengths and weaknesses

- Adherence to regulatory standards and laws

- Review of all supporting insurance documentation

- Product volume and average premiums against underwriting plans

- Cancellation reasons and quantitative information

- Claims performance (complaints, frequency, average claims costs, etc.)

- Claims declinature and indemnity referrals

- Output from broker conduct risk and Coverholder audits

- Consideration of the selection and appropriateness of the brokers

Have you tested each product?

A heat map approach is taken annually to identify products to be reviewed, which is a least once every 2 years. The Product Review Plan is approved by the ERS Board and quarterly updates provided on adherence to the Plan.

If there has been a significant change or amendment to the product, have you put the amended product back through the full PROD assessment?

No significant changes.

We have this year applied revision to cyber coverage and inclusion of cover in relation to green technology. Please refer to the Product NTP for further guidance.

Have you considered the charging and fee structure for each product?

Pricing models remain consistent and fees are charged by the broker.

Have you rationalised why you have chosen your current distribution chain?

This part of the ERS Distribution model and is deemed appropriate for the sale of products offered through a broker sale and we have sufficient controls to protect all stakeholders.

Have you identified the characteristics and features of each product?

This set out in the ERS Underwriting Appetites that can be sourced from our websites and with the product rules (i.e. SWH product criteria and Underwriting Guides for Delegated Authority).

The product approval process has identified whether each product provides fair value to customers in the target market including whether it will continue to do so for a reasonably foreseeable period, considering the pricing model used to calculate the risk premium: (i) for the initial policy term; and (ii) any future renewal

Please refer to previous comments on this is assessed.

New Products or major changes are required to go through a Product Approval Process as outlined in the ERS Underwriting Policy.

Risk Triggers that ERS identify as circumstances that prompt changes to the annually approved Product Review Plan are:

- Performance (incl. claim declinatures, complaints, cancellation rates, claims frequency)

- Revision in regulatory standards specific to motor coversAmendments to ERS standard wording or document structure

- Broker feedback that highlights concerns or opportunitiesDistribution of the products to reach the customer

- Specialist claims facility/suppliers employed to support the product

- Product used by brokers given delegated claims authority

- Released from the new business opportunities process in the last 12 months

-

Windscreen Repairs (Policyholders)

To book your windscreen repair

Call 0345 602 3378 from the UK or EU

Or you can book online (excluding coach, bus, minibus & motorhome)

-

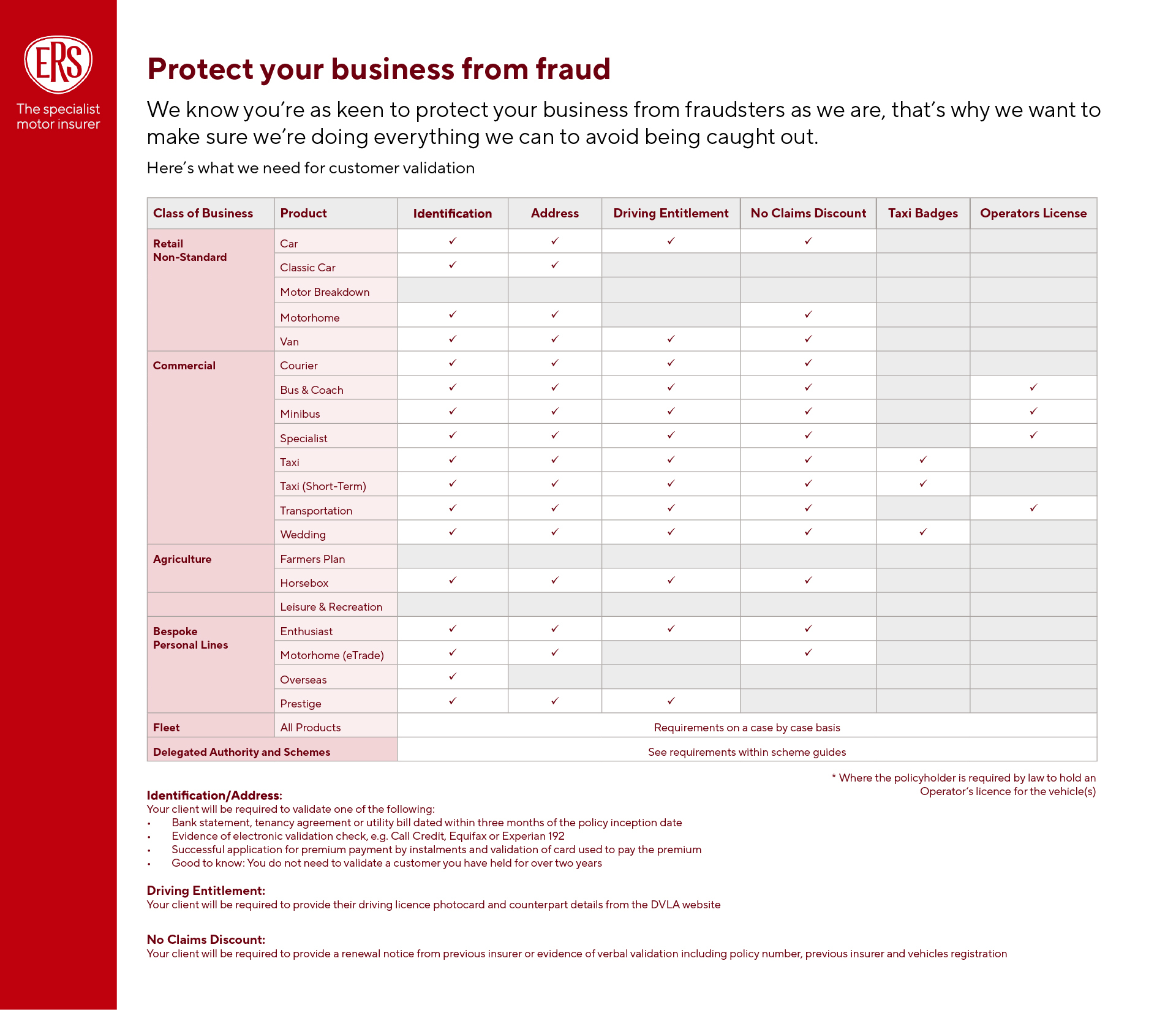

Fraud copy

How do I report claims fraud?

If you suspect fraud then please contact our dedicated hotline on 03300 535 891. All calls will be treated in the strictest confidence.

How does ERS prevent claims fraud?

ERS has a zero tolerance to claims fraud because it can negatively affect innocent policyholders in two ways:

- The Association of British Insurers believes that it adds £50 to the cost of motor insurance premiums.

- Criminals may seek to manoeuvre innocent motorists into induced accidents in order to benefit from claims.

If you suspect fraud then please contact our dedicated hotline on 03300 535 891. All calls will be treated in the strictest confidence.

How does ERS prevent application fraud?

It is important that your insurance policy is based on the correct information.

Providing incorrect or false details, or failing to disclose information when requested, could render your insurance policy as 'null and void' or cancelled.

To ensure we sell the correct cover, the following are details which may be checked by ERS, or your broker on our behalf:

- Your claims history

- Your identity

- Your address

- The validity of any debit or credit card used to purchase your policy – to ensure that stolen and cloned cards are not used

- Your No Claims Bonus entitlement

- The ownership of your vehicle

- Any motoring convictions you have

- Your taxi license - if applicable

- That approved security devices are fitted - where required under our policy terms Whether you or any named drivers have had previous insurance cancelled or declared void for fraud reasons

Who does ERS work with to prevent fraud?

To help prevent fraud, we work with the following organisations:

- Insurance Fraud Bureau - the IFB are a 'not for profit' organisation focussed on detecting and preventing organised insurance fraud.

- Insurance Fraud Enforcement Department - the IFED are a dedicated team at City of London Police, targeting the investigation of insurance fraud at all levels and from all sectors.

ERS Validation requirements