Home / Resources & help

Resources & help

Search our frequently asked questions

Our policies are available exclusively through UK brokers

Frequently asked questions

If you can't find the answer you're looking for? Contact our team who will be happy to help.

About ERS

Our accreditations and policies including information on the modern slavery act.

ERS is a Lloyd’s underwriting business (Syndicate 218) that has been a leading motor insurer for over 75 years. As a motor only, broker only insurer, our policies are only available exclusively through UK insurance brokers.

We offer a wide range of cover for private cars, classic cars, vans, supercars, imported vehicles, taxis, minibuses, fleets, haulage, agricultural vehicles as well as for high risk drivers, sports people and celebrities.

Being Lloyd’s rated reassures brokers and their customers that an insurer has complied with Lloyd’s stringent regulations meaning that it’s very remote that the insurer will ever fail and leave a customer exposed with no insurance. In fact, no insurer has failed since Lloyd’s oversight regime was put in place. This gives security to both customers and brokers

Additionally, a Lloyd’s rating comes with a rating from Standard and Poor’s. ERS’ S&P rating is A+ which means brokers and their customers can depend on our policies.

If a Lloyd’s rated insurer did ever fail, all policies are honoured by Lloyd’s and claims are paid from a guaranteed central fund by Lloyd’s – customer and brokers are always protected if a Syndicate cannot meet its obligations.

If you choose not to select insurance from a rated insurer, we recommend you use the litmus test from BIBA.

If you’re a broker, visit our Contact page for all your relevant contacts.

If you have customers who would benefit from bespoke motor insurance cover tailored to their specific needs, then we’re here to help. Fill in your details and we’ll get in touch.

Visit our Broker page for information on how to trade each of our products

The Group and subsidiary companies comply with the Companies Act requirement to disclose a section 172 statement within their Strategic Reports. This is a statement explaining how the directors have carried out their duty to promote the success of the company for the benefit of members as a whole. Please see the attached 2019 Consolidated Financial Statements of ERS DGB Limited which contain the Group section 172 statement.

ARC

Find links to ARC here.

The Account Reconciliation Centre (ARC) lets you settle your account online quickly and easily and switch from paper statements to electronic delivery of your premiums.

Once you’ve registered, we’ll move your statement over to ARC and send you an email confirming that you can start accessing your account online.

Broker marketing

Raise your profile with bespoke marketing material from our list of preferred suppliers.

Sign up to our Marketing Hub to download and co-brand a range of leaflets to support your marketing initiatives. Sign up here.

Our ERS Stories get under the bonnet of some of the vehicles we cover with our broker partners; sharing incredible stories of fantastic vehicles, their drivers and the brilliant things they do.

If we’ve covered a risk that would make a great ERS Story get in touch with the team at communications@ers.com

Yes. We’re happy for you to use the ERS name logo in your communications, but please refer to our Terms and Conditions for a few rules.

You can get the latest logo by emailing communications@ers.com.

Claims

Everything you need to know about making a claim, from when to report an incident to paying policy excess.

If you’ve had an accident, please call us within 24 hours on 0330 123 5992. We’ll organise your car for repair and get you a replacement vehicle should you require one.

Your car will be looked after by our approved network or repairers, cleaned, valeted and delivered back to you at home or work

- Once everyone is safe, please phone us immediately (and definitely within 24 hours) on 0330 123 5992 for general claims or 0345 602 3378 for windscreen claims

- Give the other party your car registration, name and phone number and tell them you’re insured with ERS. Make sure you get the same details from them.

- Take photographs of damage to all vehicles and the scene of the accident if it’s safe

- Make sure you take a note of the number of people in the other vehicle(s)

If your vehicle has been involved in an accident, we’ll collect it and deliver it to one of our approved network or repairers.

We’ll keep you updated through the claim (or pass the information to your motor insurance broker), so you know when your vehicle will be ready.

ERS only use original parts by default, so you know you’ll get exactly the right parts for your vehicle – unless you ask us not to. Once it’s repaired, it’ll be fully valeted and delivered back to you at home or work.

ERS works with the Innovation Group and their national network of approved repairers. Our repair network can look after pretty much any vehicle type, from a standard car or van to a Tesla, McLaren or Bentley and, as we only work with BS10125 accredited repairers, your customers’ vehicles are in safe hands. What’s more, we’ll provide your customers with a courtesy car and, once your vehicle is repaired, deliver it back to you at home or work valeted inside and out.

To help our engineers progress the claim quickly, it's important you take good quality images and videos. Here are a few tips to help:

Ensure you take some vital shots:

- Take a photo of your driving license / passport

- Take a photo of the VIN and the vehicle registration plate

- Take shots of the interior of the vehicle including seats, dashboard (with mileage)

- Then, outside the car, from each corner so we can see the front, sides and rear

Once the vitals are done, you need to send photos of the damage

- It’s important to get a tight photo of the damage, so stand nice and close

- Ensure you get a few photos from different angles, including underneath the car. The more photos the better.

Once you’re done, send your photos / videos to your broker who can submit them on your behalf.

Differential excesses applied to all new business and renewals on Everyday Car and Taxi products between 1st August 2017 and 31st May 2019. For policies incepted or renewed from 1st June 2019, the differential excesses relating to late reported claims, and discounts for early reported claims will only apply to Taxi and High Risk car and van schemes. There will be no change to the increased excess where your vehicle is repairable, but not repaired at one of our Approved Repairers.

Where applicable, the discounted early reporting excess, increased late reporting excess and non-approved repairer excess is applied to the AD element of an RTA claim only and will be paid in addition to any other excess on a claim. The excesses are cumulative.

A claim that is not reported to ERS quickly can typically cost over £1,000 more than a claim that is reported earlier. Ultimately increased costs can mean increased premiums for our customers, so we aim to reduce costs as much as possible to keep premiums low. The addition of a differential excess aims to encourage brokers and policy holders to report claims early, helping us manage the claim and keep costs low.

We have introduced a discounted excess for policy holders who report a claim within 1 day and a late reporting excess to claims reported in more than 2 days after the incident. These excesses apply to RTA claims where there is a third party road user involved (e.g. TP driver, TP passenger, cyclist, pedestrian, own passenger, motorcyclist).

Repairs where non-approved repairers are used cost ERS considerably more on average, hence the increased excess application to repairs when a non-approved repairer is being used.

Currently, Taxi, High Risk (Non-Standard) Car and Van are subject to differential excesses. Everyday Car and Van and Rural Car and Van products are subject to an excess if an ERS Approved Repairer is not utilised where the vehicle is repairable.

Currently, Taxi, High Risk (Non-Standard) Car and Van are subject to differential excesses. Everyday Car and Van and Rural Car and Van products are subject to an excess if an ERS Approved Repairer is not utilised where the vehicle is repairable.

However, these changes only apply to ERS’ own wordings. Brokers with their own policies do not need to change their terms.

Whilst we appreciate that there will always be exceptional circumstances, policy holders, named drivers or brokers are expected to notify ERS of a claim within the appropriate time frame unless they are unable to do so. In exceptional circumstances, such as the policy holder being seriously injured in the accident, we will apply our discretion as to whether the late reporting excess applies.

A policy holder, named driver or broker can report a claim to ERS 24 hours a day, 7 days a week, including public holidays.

The reporting window starts on the day of the accident. Rather than apply a strict 24/48 hour window. However, ERS provides some leeway in terms of timing. If the accident occurs at 9am on Sunday, Sunday is day 0, Monday is day 1, Tuesday is day 2 and Wednesday day 3. Therefore, if the accident is reported to us on Sunday or Monday, the insured will get the benefit of a reduced AD excess, if reported on Tuesday, they pay their standard excess but if on Wednesday or later, they will pay the additional excess.

We only accept notification of claims from the policy holder, a named driver on the policy or the policy holder's broker.

If our approved network of repairers cannot repair the vehicle, we will not penalise the insured with an increased excess, however it is at our discretion as to whether the vehicle can be suitably repaired. This would also apply where the insured is in a remote location where there is no approved repairer.

We will honour any renewals invited on the old terms regardless of when the terms are accepted.

Whilst the claim notification may initially be made to an accident management company, all claims must be made to ERS within the specific time frame.

ERS provide a claims notification service 24 hours a day, seven days a week to ensure all brokers and policy holders can notify us of a claim within the specified time

Yes. The policy holder, broker or accident management company must report any incident to us within the specified time frame, even if there is no intention to claim against the motor insurance policy. This is because liability is not always clear and can be disputed. If the policy holder subsequently wishes to claim on their motor insurance, they will be liable for the increased late reporting excess.

The Employers' Liability Register shows each ERS employer's liability policy which has been entered into, renewed or for which claims have been made on or after 1st April 2011.

The register also shows any ERS employers' liability policy for which claims have been made before 1st April 2011 and have not yet been settled.

You can view our current Employer's Liability Register here.

If you have any queries regarding any policy shown on this register, please email our Compliance Team on compliance@iquw.com or call 020 3824 5589.

Complaints

We aim to provide a first class service, but if anything ever goes wrong you’ll find how to make a complaint here.

If you have any reason to raise a complaint on behalf of our Policyholder, please see refer to our Policyholder response.

Written authority should be provided by the Policyholder prior to dealing with a complaint on their behalf.

If you as a broker are unhappy with our service, please contact your Regional Development Manager (RDM). A list of RDM’s by geographical area and contact details are available here.

Alternatively, email: brokerconduct@ers.com

Our office hours are 9.00am to 5.00pm, Monday to Friday.

Or you can write to us at the following address:

Customer Relations Department, ERS, Crucible Park, Llansamlet, Swansea SA7 0AB

Please quote the insurance document number in any communication, which is shown on the Policyholder’s certificate of insurance and schedule. If known, please quote the claim reference number.

Should you be dissatisfied with our response to your complaint, you can refer your complaint to Lloyd's. Lloyd's will investigate the matter and provide a final response. Lloyd's contact details are as follows:

Complaints

Lloyd’s

One Lime Street

London

EC3M 7HA

E-mail: complaints@Lloyds.com

Telephone: +44 (0) 20 7327 5693

Fax: +44 (0) 20 7327 5225

Website: www.lloyds.com/complaints

If you ask someone else to act on your behalf, you should give us written authority to allow us to deal with them.

If you are dissatisfied with Lloyd’s final response, you may, if eligible, refer your complaint to the Financial Ombudsman Service (FOS). The Financial Ombudsman Service is an independent service in the UK for settling disputes between consumers and businesses providing financial services.

The FOS's contact details are as follows:

Financial Ombudsman Service

Exchange Tower

London

E14 9SR

E-mail: complaint.info@financial-ombudsman.org.uk

Telephone: +44 (0)300 123 9123

Website: www.financial-ombudsman.org.uk

ERS resolve over 70% of complaints informally over the telephone within 3 business days.

Please see details of each stage of the complaint journey

As a Lloyd’s Market Syndicate, we follow the Lloyd’s Complaints Process (as agreed by the FCA).

Complaints not resolved informally within 3 business days will be subject to a formal investigation and written ‘Stage One’ response letter in accordance with the Lloyds complaints procedure.

Please see the timeline of a potential complaint journey.

One of the Industry standard measures for complaints is: Complaints per 1000 Policies (as a percentage) Please see ERS performance when compared to industry competitors.

| Insurer | Complaints per 1,000 policies |

| ERS | 0.68 |

| Ageas | 0.79 |

| Zurich | 1.51 |

| Markerstudy | 1.89 |

| NFU | 2.36 |

| RSA | 2.64 |

| AXA | 4.73 |

| QBE | 6.08 |

Cover Note and Green Card portal

Brokers can register using this form. Once this has been submitted ERS will review the application and users will get an email once approved.

If you already have your log in details, you can sign in here.

Please note:

- Shared inboxes, shared login details, and/or shared authenticator apps/devices are not permitted.

- Username & Passwords for this site are not the same as ERS Online.

- Password resets can be made by following this link. This will require a username to be provided, if you cannot remember your username contact agency@ers.com

You can use our e-cover note portal to provide insurance for your customers if we’re not available and if you have the authority to do so. Sign in to the ERS Cover Note and Green Card Portal.

If it is an account issue no longer have access to your email account, users needing deactivation etc.), please contact agency@ers.com and if it is a technical issue (Portal is offline, server/page/redirect errors etc.) please contact servicedesk@iquw.com

For more information on Green Cards please see the Leaving the EU and Green Cards section.

Please contact agency@ers.com for any Cover Notes and Green Cards created before the 21.09.2023

You can view the ERS Cover Note and Green Card Portal guide here.

ERS Online and eTrade

Everything you need to know about using ERS online.

ERS Online is the single sign-on destination that hosts our broker trading portal, ERS eTrade and broker claims portal. You can sign up here.

ERS eTrade is our online trading platform for the fastest way to trade a range of our products. Find out here which products are available to trade online now and coming soon plus how to sign up.

You can sign in to ERS eTrade here.

Can I add a shared mailbox email address as a user so that multiple users can share it?

No, the system requires an individual email address and password per user, for security reasons. If your organisation is unable to accommodate this, please contact agency@ers.com with full details.

What happens if I didn’t activate my account within 24 hours?

Don’t worry, simply forward your activation email to agency@ers.com and let them know that you missed the activation window. They’ll send another activation email as quickly as they can.

Do I need any special software to use ERS online services?

No. ERS is a standard web-based application. You’ll need a computer or mobile device that’s connected to the internet to use it. ERS eTrade is compatible with Internet Explorer, Google Chrome and Firefox.

Are there any minimum password requirements?

Yes. Your password needs to be a minimum of eight characters, upper and lower case, alphanumeric and have a special character such as !,<*#@.

What happens if I forget my password?

If you have forgotten your password, select ‘Forgotten your password’ from the log in screen and follow the instructions.

If you get your password incorrect eight times your account will be locked. You will need to contact agency@ers.com for a password reset.

What is the difference between an Administrator and a User, and group/branch access levels?

An Administrator is able to add and remove colleagues to ERS eTrade: Download our User and Administrator guides to see how to navigate through ERS eTrade

Request access: agency@ers.com

Password reset: agency@ers.com

User management: Your agency Administrator can add new users to eTrade download the Admin guide [here] if you still have user management questions, contact agency@ers.com

Technical issue: Please send a screenshot of the issue to technicalhelpdesk@ers.com

Trading support: All the eTrade and online trading support contacts can be found on the individual product pages for questions relating to specific Quotes > MTA > Renewals

User support: visit our eTrade Support Hub for user guides and walkthrough videos

If you require training on eTrade we have a range of tools to support, visit our eTrade Support Hub for a range of videos, FAQs and downloads to support your online trading experience with us.

FCA Fair Pricing

In 2021, the FCA published final rules regarding insurance pricing practices and specific requirements around annual Product Governance. The aim of these new rules is to ensure that Policyholders get fair access to suitable products, whilst paying a fair price.

For ERS branded products, we are deemed to be the product manufacturer. We have an established process in place ensuring that all our motor insurance products are subject to regular scrutiny to meet the needs of our target markets. These plans and Product Reviews are regularly shared with Lloyd’s over the years and have met with their approval in terms of our general approach, the content of and regularity of reviews.

In the light of these new requirements, we have updated our Product Review programme to ensure that reviews take place at least every 12 months and, more regularly, if required. The need for more frequent review will be highlighted by the quarterly Head of Product Attestation process which we believe to be a very constructive control over this review process.

We have produced the following set of Frequently Asked Questions on this subject which we hope you will find to be helpful.

ERS is the manufacturer of all Products sold by this broker branded as ERS throughout the customer document pack.

ERS has a Product Review Framework and supporting Product Review Plan that is approved annually by the ERS Board. All products reviewed are presented to the Product Oversight Group (POG) for their approval and actions set. Quarterly updates are provided to the ERS Risk and Compliance Committee on behalf of the ERS Board.

Yes, a Product Review assesses the target market with demographic data against the Risk Appetite set by Underwriters for each Product to ensure we identify anomalies to this and take appropriate action, where needed.

The core elements of an ERS Product Review are:

- Coverage offered across all the schemes for the product

- Benchmarking across the motor insurance market (a minimum of 3 competitors)Identification of strengths and weaknesses

- Adherence to regulatory standards and laws

- Review of all supporting insurance documentation

- Product volume and average premiums against underwriting plans

- Cancellation reasons and quantitative information

- Claims performance (complaints, frequency, average claims costs, etc.)

- Claims declinature and indemnity referrals

- Output from broker conduct risk and Coverholder audits

- Consideration of the selection and appropriateness of the brokers

A heat map approach is taken annually to identify products to be reviewed, which is a least once every 2 years. The Product Review Plan is approved by the ERS Board and quarterly updates provided on adherence to the Plan.

No significant changes.

We have this year applied revision to cyber coverage and inclusion of cover in relation to green technology. Please refer to the Product NTP for further guidance.

Pricing models remain consistent and fees are charged by the broker.

This part of the ERS Distribution model and is deemed appropriate for the sale of products offered through a broker sale and we have sufficient controls to protect all stakeholders.

This set out in the ERS Underwriting Appetites that can be sourced from our websites and with the product rules (i.e. SWH product criteria and Underwriting Guides for Delegated Authority).

Please refer to previous comments on this is assessed.

New Products or major changes are required to go through a Product Approval Process as outlined in the ERS Underwriting Policy.

Risk Triggers that ERS identify as circumstances that prompt changes to the annually approved Product Review Plan are:

- Performance (incl. claim declinatures, complaints, cancellation rates, claims frequency)

- Revision in regulatory standards specific to motor coversAmendments to ERS standard wording or document structure

- Broker feedback that highlights concerns or opportunitiesDistribution of the products to reach the customer

- Specialist claims facility/suppliers employed to support the product

- Product used by brokers given delegated claims authority

- Released from the new business opportunities process in the last 12 months

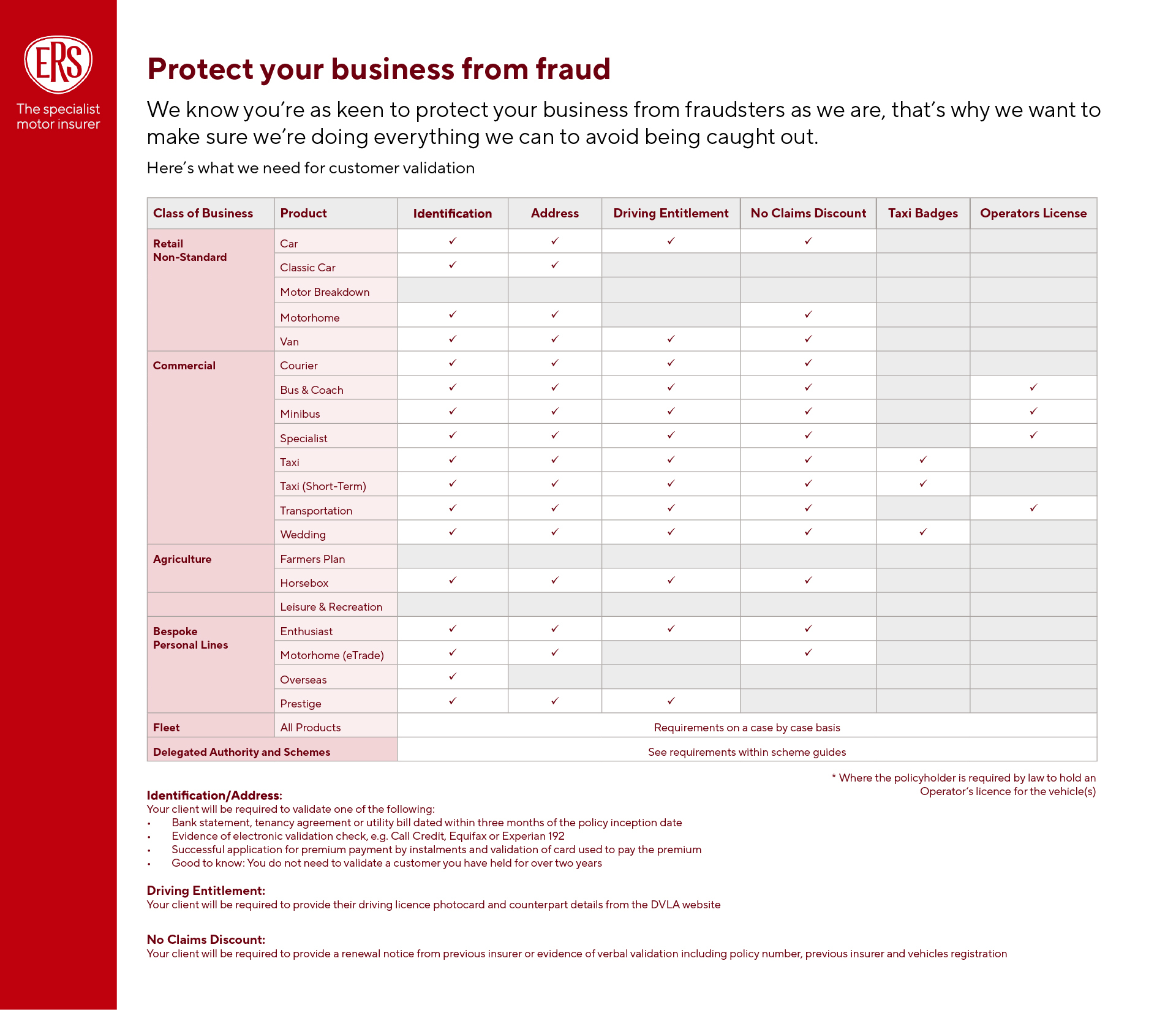

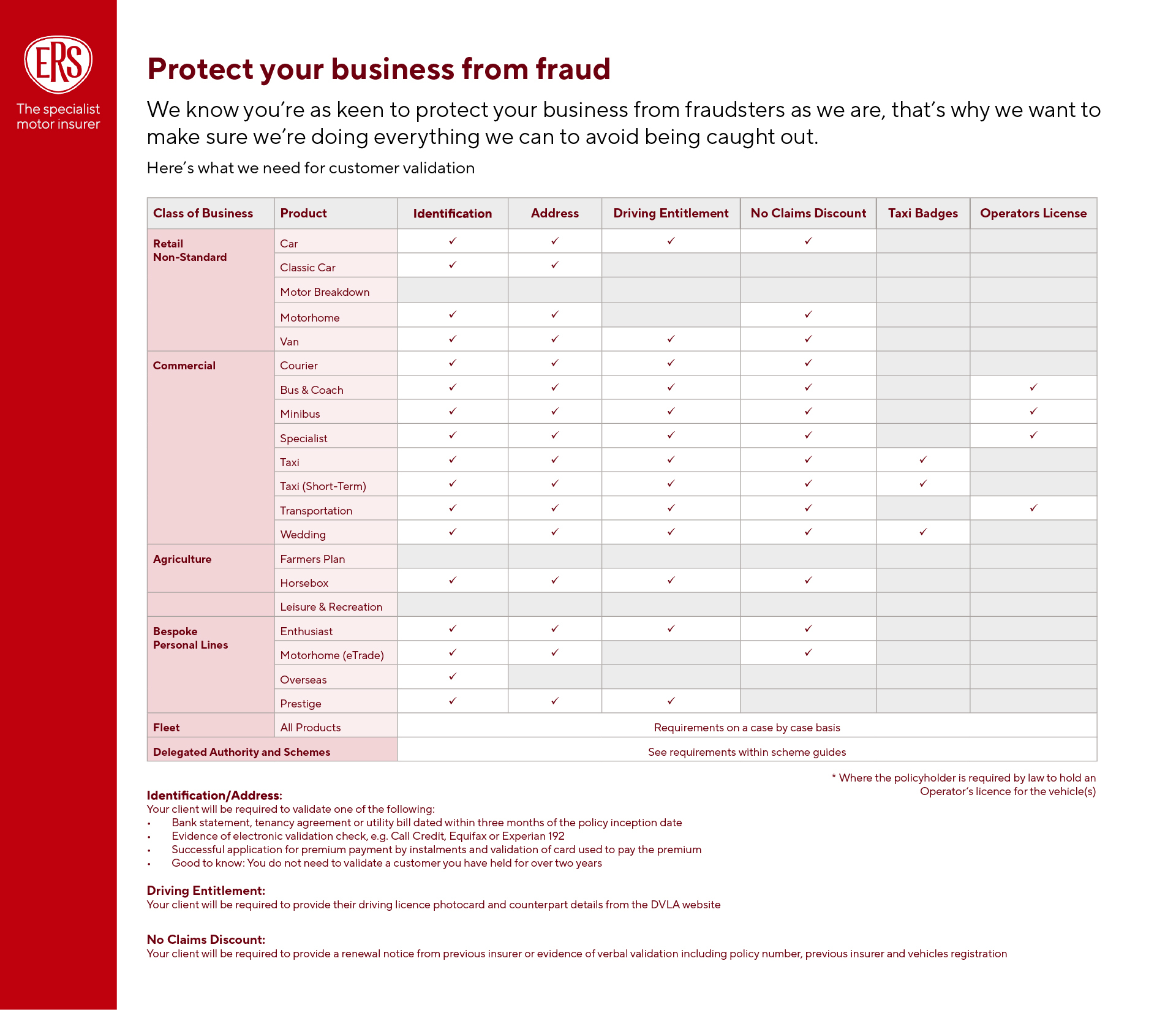

Fraud

We treat fraud extremely seriously. Find out more about our policy and initiatives to prevent and mitigate fraud.

If you suspect fraud then please contact our dedicated hotline on 03300 535 891. All calls will be treated in the strictest confidence.

ERS has a zero tolerance to claims fraud because it can negatively affect innocent policyholders in two ways:

- The Association of British Insurers believes that it adds £50 to the cost of motor insurance premiums.

- Criminals may seek to manoeuvre innocent motorists into induced accidents in order to benefit from claims.

If you suspect fraud then please contact our dedicated hotline on

03300 535 891. All calls will be treated in the strictest confidence.

It is important that your insurance policy is based on the correct information.

Providing incorrect or false details, or failing to disclose information when requested, could render your insurance policy as 'null and void' or cancelled.

To ensure we sell the correct cover, the following are details which may be checked by ERS, or your broker on our behalf:

- Your claims history

- Your identity

- Your address

- The validity of any debit or credit card used to purchase your policy – to ensure that stolen and cloned cards are not used

- Your No Claims Bonus entitlement

- The ownership of your vehicle

- Any motoring convictions you have

- Your taxi license - if applicable

- That approved security devices are fitted - where required under our policy terms Whether you or any named drivers have had previous insurance cancelled or declared void for fraud reasons

To help prevent fraud, we work with the following organisations:

- Insurance Fraud Bureau - the IFB are a 'not for profit' organisation focussed on detecting and preventing organised insurance fraud.

- Insurance Fraud Enforcement Department - the IFED are a dedicated team at City of London Police, targeting the investigation of insurance fraud at all levels and from all sectors.

Leaving the EU & Green Cards

Green Card Update: Published on 13th July 2021, the European Commission has agreed the UK will be included in the Green Card free zone that takes effect from 2nd August 2021. This means all UK vehicles driving in the EU and EEA states will require Green Cards for travel up to and until 1st August 2021, 23:59 hours. ERS will continue to offer access to Green Card Portal beyond this date, as it may take a short while for the news to filter through to European border and roads policing authorities across to European border and roads policing authorities. For any immediate Green Cards required for July/August travel, visit covernote.ers.com/login

The Green Card is an international Certificate of Insurance, providing visiting motorists have the minimum compulsory insurance cover required by law of the countries subject to the Green Card free circulation area, as currently permitted within ERS policy wordings (see Foreign Use section).

You do not need to carry a green card when you drive in the EU (including Ireland), Andorra, Bosnia and Herzegovina, Iceland, Liechtenstein, Norway, Serbia, and Switzerland. Details can be found on www.gov.uk/vehicle-insurance/driving-abroad

If you are driving with a trailer or caravan, you may need to register it before travelling. Details can be found www.gov.uk/guidance/trailer-registration

If the customer is travelling outside the UK with their vehicle and foreign use is extension is covered by the policy coverage. Then the countries covered automatically by the Green Card are as follows:

EU Countries: Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain & Sweden

EEA Countries: Andorra, Iceland, Liechtenstein, Norway, Serbia and Switzerland

For travel to Gibraltar, please refer to the specific question further down in these FAQs.

Under the EU Commission definition of Gibraltar, it is including under the United Kingdom as is the Channel Islands and Isle of Man. This means there is no issue with Green Cards or existing policy coverage offered under the foreign use section.

UK registered vehicles will need to display a GB sticker when driving in any of the EU countries, though you do not need to display a GB sticker to drive in the Republic of Ireland (as stated on the UK Government website).

The Green Card Portal will only cover countries in the EEA, Andorra, Serbia and Switzerland as permitted currently within the ERS Policy (where applicable). If additional countries are required then a request will need to be made to greencards@ers.com stating the country that the customer wishes to visit.

No, since 1st July 2020 the EU Commission agreed that the Green Card can be printed on either green or white paper with black ink and this was now acceptable by all participating countries.

No, a physical copy of a Green Card on plain A4 white or green paper is needed when travelling, as digital copies are not currently accepted. If customers arrive at the border without a physical Green Card on plain white or green paper, they will not be allowed to drive in that country. ERS are permitted to share a Green Card with policyholders in an electronic format, however, to be accepted at international borders they must be printed.

Policyholders are advised to contact their insurance broker or intermediary to request a Green Card if they're travelling outside the UK in their insured vehicle from the 31st December 2020.

Please note this must be printed on A4 plain white or green paper to be valid and effective dates of cover must be within the period of insurance shown on the Certificate of Insurance.

Brokers can register using this form. Once this has been submitted ERS will review the application and users will get an email once approved

See separate ERS Cover Note and Green Card Portal access FAQ's.

If you are experiencing problems producing the Green Cards through the ERS Cover Note and Green Card Portal, then please send your query by email to agency@ers.com and we will provide a response within 24 hours.

Motor Insurance Bureau (MIB)

The MID (Motor Insurance Database) contains the insurance policy details of all insured UK vehicles. It is accessed by different people, in different ways, for different purposes.

The Motor Insurance Database (MID) is the only centralised database of motor insurance policy information for all insured vehicles. Information is retained for 7 years.

All insurers who underwrite motor insurance for vehicles on UK roads are obliged to be members of the MIB and to submit the policy details of ALL vehicles to the MID.

The process of getting the information to the MID is managed by MIB but the data is loaded directly by insurers (i.e. ERS).

The database can be used by various public bodies such as the police, the DVLA and by insurers and the MIB itself.

Any driver may check that their vehicle is registered on the MID by using www.askmid.com

The police are the Motor Insurance Database's (MID) biggest user, making over 2 million enquiries every month.

The police have access to the database to assist in the identification of uninsured vehicles and to enhance their enforcement powers to remove them from our roads.

The MIB, which runs the MID, provides British police forces with an extract of data showing potentially uninsured vehicles.

This data is used within Automatic Number Plate Recognition (ANPR) cameras throughout the UK. This means that if a vehicle passes an ANPR camera it is likely to be stopped if it is not showing insured.

The police can seize any vehicle where they have reasonable grounds to believe it is uninsured. To support the police in the fight against uninsured driving, the MIB runs a dedicated Police Helpline. This Helpline supports difficult roadside situations where there is doubt over the validity of insurance cover.

Review the query and ensure the policy information held is accurate and if still an issue then contact ERS by

Policy docs, IPIDs and Key Facts

All the paperwork you ever need to put together an ERS policy for a customer can now be found in our For Brokers pages, or on the relevant product page.

About ERS (Policyholders)

ERS is a Lloyd’s underwriting business (Syndicate 218) that has been a leading motor insurer for over 70 years. As a motor only, broker only insurer, our policies are only available exclusively through UK insurance brokers.

We offer a wide range of cover for private cars, classic cars, vans, supercars, imported vehicles, taxis, minibuses, fleets, haulage, agricultural vehicles as well as for high risk drivers, sports people and celebrities.

We don’t publish a list of ERS brokers, however, if you are looking for a motor insurance broker, we recommend finding a broker using BIBAs recommended list. When you find a broker you’d like to use, just ask for the ERS price on your risk.

Being Lloyd’s rated reassures brokers and their customers that an insurer has complied with Lloyd’s stringent regulations meaning that it’s very remote that the insurer will ever fail and leave a customer exposed with no insurance. In fact, no insurer has failed since Lloyd’s oversight regime was put in place. This gives security to both customers and brokers

Additionally, a Lloyd’s rating comes with a rating from Standard and Poor’s. ERS’ S&P rating is A+ which means brokers and their customers can depend on our policies.

If a Lloyd’s rated insurer did ever fail, all policies are honoured by Lloyd’s and claims are paid from a guaranteed central fund by Lloyd’s – customer and brokers are always protected if a Syndicate cannot meet its obligations.

If you choose not to select insurance from a rated insurer, we recommend you use the litmus test from BIBA.

If you’re a policyholder with a question about your ERS policy the best person to contact is your broker, who will know your policy and be able to answer all your questions.

If you need to report a claim please visit here for more information

If you need to report a breakdown here's all the numbers you need

COVID-19 (Policyholder)

Claims (Policyholder)

If you’ve had an accident, please call us within 24 hours on 0330 123 5992. We’ll organise your car to be repaired and get you a replacement vehicle should you require one.

Once everyone is safe, please call our 24-hour helpline immediately from the UK or EU on 0330 123 5992.

For windscreen claims call 0345 602 3378.

You can help speed up the claims process by collecting as much information about the incident as possible, for example:

- Name, contact details and insurance provider for all parties involved in the incident.

- Vehicle registration numbers or make and model.

- Photos of the areas of damage on the vehicles involved and positioning of the vehicles, if safe to do so.

- Details of any injuries to all parties.

- Location of the incident and a diagram showing what happened.

- Name and contact details of any witnesses, and police officers who attend.

- Back up any dashcam or phone video footage.

If your vehicle has been involved in an accident, we’ll collect it and deliver it to one of our approved network or repairers.

We’ll keep you updated through the claim (or pass the information to your motor insurance broker), so you know when your vehicle will be ready.

ERS only use original parts by default, so you know you’ll get exactly the right parts for your vehicle – unless you ask us not to. Once it’s repaired, it’ll be fully valeted and delivered back to you at home or work.

ERS works with the Innovation Group and their national network of approved repairers. Our repair network can look after pretty much any vehicle type, from a standard car or van to a Tesla, McLaren or Bentley and, as we only work with BS10125 accredited repairers, your customers’ vehicles are in safe hands. What’s more, we’ll provide your customers with a courtesy car and, once your vehicle is repaired, deliver it back to you at home or work valeted inside and out.

To help our handlers and engineers progress your claim quickly, it's important you take good quality images and videos. Here are a few tips to help:

- Take a photo of the VIN and the vehicle registration plate

- Take shots of the interior of the vehicle including seats, dashboard (with mileage)

- Then, the outside of the vehicle, from each corner so we can see the front, sides, and rear

- It’s important to get a tight photo of the damage, so get a close shot

- Ensure you get a few photos from different angles, including underneath the vehicle. The more photos the better.

Once you’re done, send your photos/videos to us at claims@ers.com or to your broker who can submit them on your behalf.

Early/late reporting excess applies to:

- Non-standard Car and Van

- Taxis

- Non-standard Taxis

Non approved repairer excess applies to:

- Private Car and Van

- Non-standard Car and Van

- Taxi’s

- Non-standard Taxi’s.

Where applicable, the discounted early reporting excess, increased late reporting excess and non-approved repairer excess is applied to the AD element of an RTA claim only and will be paid in addition to any other excess on a claim. The excesses are cumulative.

A claim that is not reported to ERS quickly can typically cost over £1,000 more than a claim that is reported earlier. Ultimately increased costs can mean increased premiums for our customers, so we aim to reduce costs as much as possible to keep premiums low. The addition of a differential excess aims to encourage brokers and policy holders to report claims early, helping us manage the claim and keep costs low.

We have introduced a discounted excess for policy holders who report a claim within 1 day and a late reporting excess to claims reported in more than 2 days after the incident. These excesses apply to RTA claims where there is a third party road user involved (e.g. TP driver, TP passenger, cyclist, pedestrian, own passenger, motorcyclist).

Repairs where non-approved repairers are used cost ERS considerably more on average, hence the increased excess application to repairs when a non-approved repairer is being used.

Currently, Taxi, High Risk (Non-Standard) Car and Van are subject to differential excesses. Everyday Car and Van and Rural Car and Van products are subject to an excess if an ERS Approved Repairer is not utilised where the vehicle is repairable.

Currently, Taxi, High Risk (Non-Standard) Car and Van are subject to differential excesses. Everyday Car and Van and Rural Car and Van products are subject to an excess if an ERS Approved Repairer is not utilised where the vehicle is repairable.

However, these changes only apply to ERS’ own wordings. Brokers with their own policies do not need to change their terms.

Whilst we appreciate that there will always be exceptional circumstances, policy holders, named drivers or brokers are expected to notify ERS of a claim within the appropriate time frame unless they are unable to do so. In exceptional circumstances, such as the policy holder being seriously injured in the accident, we will apply our discretion as to whether the late reporting excess applies.

A policy holder, named driver or broker can report a claim to ERS 24 hours a day, 7 days a week, including public holidays.

The reporting window starts on the day of the accident. Rather than apply a strict 24/48 hour window. However, ERS provides some leeway in terms of timing. If the accident occurs at 9am on Sunday, Sunday is day 0, Monday is day 1, Tuesday is day 2 and Wednesday day 3. Therefore, if the accident is reported to us on Sunday or Monday, the insured will get the benefit of a reduced AD excess, if reported on Tuesday, they pay their standard excess but if on Wednesday or later, they will pay the additional excess.

We only accept notification of claims from the policyholder, a named driver on the policy or the policyholder's broker.

If our approved network of repairers cannot repair the vehicle, we will not penalise the insured with an increased excess, however it is at our discretion as to whether the vehicle can be suitably repaired. This would also apply where the insured is in a remote location where there is no approved repairer.

We will honour any renewals invited on the old terms regardless of when the terms are accepted.

Whilst the claim notification may initially be made to an accident management company, all claims must be made to ERS within the specific time frame.

ERS provide a claims notification service 24 hours a day, seven days a week to ensure all brokers and policy holders can notify us of a claim within the specified time

Yes. The policy holder, broker or accident management company must report any incident to us within the specified time frame, even if there is no intention to claim against the motor insurance policy. This is because liability is not always clear and can be disputed. If the policyholder subsequently wishes to claim on their motor insurance, they will be liable for the increased late reporting excess.

The Employers' Liability Register shows each ERS employer's liability policy which has been entered into, renewed or for which claims have been made on or after 1st April 2011.

The register also shows any ERS employers' liability policy for which claims have been made before 1st April 2011 and have not yet been settled.

You can view our current Employer's Liability Register here.

If you have any queries regarding any policy shown on this register, please email our Compliance Team on compliance@iquw.com or call 020 3824 5589.

Complaints (Policyholder)

If you have any reason to complain about your insurance policy, or us, please contact our dedicated complaints handling department on 0345 268 0279 or email complaints@ers.com

Our office hours are 9.00am to 5.00pm, Monday to Friday.

Alternatively, you can write to us at the following address:

Customer Relations Department, ERS, Crucible Park, Llansamlet, Swansea SA7 0AB

Please quote your insurance document number in any communication, which is shown on your certificate of insurance and schedule. If known, please quote your claim reference number.

If you ask someone else to act on your behalf, you should give us written authority to allow us to deal with them.

If you have any reason to raise a complaint on behalf of our Policyholder, please see instruction above.

Written authority should be provided by the Policyholder prior to dealing with a complaint on their behalf.

Should you be dissatisfied with our response to your complaint, you can refer your complaint to Lloyd's. Lloyd's will investigate the matter and provide a final response. Lloyd's contact details are as follows:

Complaints

Lloyd’s

One Lime Street

London

EC3M 7HA

E-mail: complaints@Lloyds.com

Telephone: +44 (0) 20 7327 5693

Fax: +44 (0) 20 7327 5225

Website: www.lloyds.com/complaints

If you ask someone else to act on your behalf, you should give us written authority to allow us to deal with them.

If you are dissatisfied with Lloyd’s final response, you may, if eligible, refer your complaint to the Financial Ombudsman Service (FOS). The Financial Ombudsman Service is an independent service in the UK for settling disputes between consumers and businesses providing financial services.

The FOS's contact details are as follows:

Financial Ombudsman Service

Exchange Tower

London

E14 9SR

E-mail: complaint.info@financial-ombudsman.org.uk

Telephone: +44 (0)300 123 9123

Website: www.financial-ombudsman.org.uk

ERS resolve over 70% of complaints informally over the telephone within 3 business days.

Please see details of each stage of the complaint journey

As a Lloyd’s Market Syndicate, we follow the Lloyd’s Complaints Process (as agreed by the FCA).

Complaints not resolved informally within 3 business days will be subject to a formal investigation and written ‘Stage One’ response letter in accordance with the Lloyds complaints procedure.

Please see the timeline of a potential complaint journey.

One of the Industry standard measures for complaints is: Complaints per 1000 Policies (as a percentage) Please see ERS performance when compared to industry competitors.

| Insurer | Complaints per 1,000 policies |

| ERS | 0.68 |

| Ageas | 0.79 |

| Zurich | 1.51 |

| Markerstudy | 1.89 |

| NFU | 2.36 |

| RSA | 2.64 |

| AXA | 4.73 |

| QBE | 6.08 |

Fraud

We treat fraud extremely seriously. Find out more about our policy and initiatives to prevent and mitigate fraud.

If you suspect fraud then please contact our dedicated hotline on 03300 535 891. All calls will be treated in the strictest confidence.

ERS has a zero tolerance to claims fraud because it can negatively affect innocent policyholders in two ways:

- The Association of British Insurers believes that it adds £50 to the cost of motor insurance premiums.

- Criminals may seek to manoeuvre innocent motorists into induced accidents in order to benefit from claims.

If you suspect fraud then please contact our dedicated hotline on

03300 535 891. All calls will be treated in the strictest confidence.

It is important that your insurance policy is based on the correct information.

Providing incorrect or false details, or failing to disclose information when requested, could render your insurance policy as 'null and void' or cancelled.

To ensure we sell the correct cover, the following are details which may be checked by ERS, or your broker on our behalf:

- Your claims history

- Your identity

- Your address

- The validity of any debit or credit card used to purchase your policy – to ensure that stolen and cloned cards are not used

- Your No Claims Bonus entitlement

- The ownership of your vehicle

- Any motoring convictions you have

- Your taxi license - if applicable

- That approved security devices are fitted - where required under our policy terms Whether you or any named drivers have had previous insurance cancelled or declared void for fraud reasons

To help prevent fraud, we work with the following organisations:

- Insurance Fraud Bureau - the IFB are a 'not for profit' organisation focussed on detecting and preventing organised insurance fraud.

- Insurance Fraud Enforcement Department - the IFED are a dedicated team at City of London Police, targeting the investigation of insurance fraud at all levels and from all sectors.

Leaving the EU & Green Cards (Policyholder)

Green Card Update: Published on 13th July 2021, the European Commission has agreed the UK will be included in the Green Card free zone that takes effect from 2nd August 2021. This means all UK vehicles driving in the EU and EEA states will require Green Cards for travel up to and until 1st August 2021, 23:59 hours. ERS will continue to offer access to Green Card Portal beyond this date, as it may take a short while for the news to filter through to European border and roads policing authorities across to European border and roads policing authorities. For any immediate Green Cards required for July/August travel, visit ers.com/greencard

The Green Card is an international Certificate of Insurance, providing visiting motorists have the minimum compulsory insurance cover required by law of the countries subject to the Green Card free circulation area, as currently permitted within ERS policy wordings (see Foreign Use section).

From the 2nd August 2021 the UK and European Commission have agreed that UK drivers should no longer be required to carry a Green Card as proof of a valid motor insurance when driving in the EU and EEA states.

You do not need to carry a green card when you drive in the EU (including Ireland), Andorra, Bosnia and Herzegovina, Iceland, Liechtenstein, Norway, Serbia, and Switzerland. Details can be found on www.gov.uk/vehicle-insurance/driving-abroad

If you are driving with a trailer or caravan, you may need to register it before travelling. Details can be found www.gov.uk/guidance/trailer-registratioFor travel to Gibraltar, please refer to the specific question further down in these FAQs.

Under the EU Commission definition of Gibraltar, it is including under the United Kingdom as is the Channel Islands and Isle of Man. This means there is no issue with Green Cards or existing policy coverage offered under the foreign use section.

UK registered vehicles will need to display a GB sticker when driving in any of the EU countries, though you do not need to display a GB sticker to drive in the Republic of Ireland (as stated on the UK Government website).

The Green Card Portal will only cover countries in the EEA, Andorra, Serbia and Switzerland as permitted currently within the ERS Policy (where applicable). If additional countries are required then a request will need to be made to your broker.

No, since 1st July 2020 the EU Commission agreed that the Green Card can be printed on either green or white paper with black ink and this was now acceptable by all participating countries.

No, a physical copy of a Green Card on plain A4 white or green paper is needed when travelling, as digital copies are not currently accepted. If customers arrive at the border without a physical Green Card on plain white or green paper, they will not be allowed to drive in that country. ERS are permitted to share a Green Card with policyholders in an electronic format, however, to be accepted at international borders they must be printed.

Please contact your broker to attain a Green Card.

Motor Insurance Bureau (MIB)

The MID (Motor Insurance Database) contains the insurance policy details of all insured UK vehicles. It is accessed by different people, in different ways, for different purposes.

The Motor Insurance Database (MID) is the only centralised database of motor insurance policy information for all insured vehicles. Information is retained for 7 years.

All insurers who underwrite motor insurance for vehicles on UK roads are obliged to be members of the MIB and to submit the policy details of ALL vehicles to the MID.

The process of getting the information to the MID is managed by MIB but the data is loaded directly by insurers (i.e. ERS).

The database can be used by various public bodies such as the police, the DVLA and by insurers and the MIB itself.

You may check that your vehicle is registered on the MID by using www.askmid.com

The police are the Motor Insurance Database's (MID) biggest user, making over 2 million enquiries every month.

The police have access to the database to assist in the identification of uninsured vehicles and to enhance their enforcement powers to remove them from our roads.

The MIB, which runs the MID, provides British police forces with an extract of data showing potentially uninsured vehicles.

This data is used within Automatic Number Plate Recognition (ANPR) cameras throughout the UK. This means that if a vehicle passes an ANPR camera it is likely to be stopped if it is not showing insured.

The police can seize any vehicle where they have reasonable grounds to believe it is uninsured. To support the police in the fight against uninsured driving, the MIB runs a dedicated Police Helpline. This Helpline supports difficult roadside situations where there is doubt over the validity of insurance cover.

You need to contact your broker as soon as possible to resolve the matter.

Windscreen Repairs

Call 0345 602 3378 from the UK or EU

Or you can book online (excluding coach, bus, minibus & motorhome)